This is a usually a popular subject on social media and one that gets a lot of responses on both sides of the coin. In this post we will talk about importing a vehicle for permanent personal use (Nationalization) and not temporary (passing though Nicaragua or while on vacation).

Please see our updated version on this @ this link:

https://nica-biz.com/2021/11/24/10-facts-on-importing-a-vehicle-into-nicaragua-updated/

First, let’s get a few things out of the way. Yes, importing a vehicle into Nicaragua can be done, there is an age limitation on the vehicle and the taxes, duty and fees may be prohibitive. The reason being, the value of the vehicle can be determined by ADUANA (Customs) at the time and point of entry. There is an antique/classic section to the importation rules that will get you around the age limit but not the taxes, duty and fees. Still with me? Read on…

Procedure

Importing your vehicle into Nicaragua is alternatively known as “Nationalization” and requires variety of documents supporting your purchase or acquisition as well as the legal title and the paper trail of it getting here. These include, but are not limited to; a customs declaration, commercial invoice or title, bill of lading, declaration of value, fiscal solvency, bank statement showing all taxes and duties paid and the exoneration of any liens on the vehicle.

ADUANA recommends using the services of a customs agent or expediter. When the nationalization has been settled (as is the correct term), your customs agent can appear before ADUANA to receive the vehicle at the location it has been held (or you may already be using it under a temporary importation certificate). At that point it’s a matter of registering the vehicle at your local Traffic Police (Tránsito Nacional) office in much the same way as any other vehicle.

Vehicle Age Limits

For normal importation (Nationals or Foreigners) the vehicle cannot be more than (10) years old from the date of manufacture and can only be a light vehicle or a pick-up truck.

There are some exemptions to that rule;

- Those donated to; the Fire Department, the Nicaraguan Red Cross, churches and religious foundations that are legally incorporated.

- Those vehicles imported by Nicaraguans return to live in Nicaragua after having resided abroad at least one year prior to their return.

- Classic or Historical vehicles.

Foreign Resident

Residents with permanent status (5 year cedula) as a Pensionado or Rentista are exempt from the payment of import taxes and I.V.A. for the importation or local purchase of a new or used motor vehicle for their personal use (or that of their dependents). The exoneration is good for up to a maximum CIF price (cost, insurance and freight) up to Twenty Five Thousand (25,000) US Dollars. If over that amount you pay the corresponding taxes on the excess.

The imported used vehicle must not be more than seven (7) years old “from the date of manufacture” not first registration. As a Pensionado or Rentista you qualify for this benefit every four years.

Confusion over the Seven or Ten Years Limit

Other than the exoneration above given to legal residents, more confusion was created when something called the Coalition Tax Act, Ley 822 (Ley de Concertación Tributaria – LCT) was introduced, and published in the Official Gazette on the 18th of December 2014 (making it law). This legislation stated that the maximum age for an import vehicle was only 7 years and was a contradiction of an existing law. In fact it was more of an oversight than anything else and was changed back to 10 years maximum within a month. Click on this link for the Official Circular CT/040/2015 that confirms its 10 years.

Taxes Duty and Fees

As stated above, Customs have the discretion to determine the value of your import. This may not be the same as you paid for it or what you think its worth. Even if you got a deal at an auction, or won it in a raffle, you can still be taxed at the value of the vehicle as it sits on the dock at Corinto or in the parking lot at ADUANA. The tax is on the perceived value of what you are bringing in.

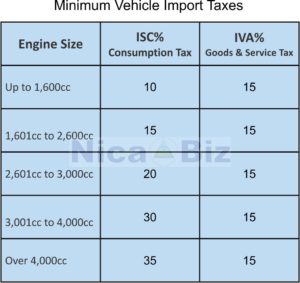

Imported vehicles are subject to the “Selective Consumption Tax” (Impuesto Selectivo de Consumo or ISC by its acronym in Spanish). In February 2019, Law 987, The Law of Reforms and Additions to Law 822 was introduced and the Selective Consumption Tax on vehicle imports now shows the various tariffs as;

IVA is a 15% Goods and Services Tax (much like in Canada or the Value Added Tax VAT in the UK) and is 15% of the value of the import.

There are a number of shipping companies that seem to have this down to a science and offer a “roll on roll off” service. You also may have to pay storage at this end depending on how long it was in customs before you got it out.

I hope this helps give you an idea of the potential costs of importing a vehicle into Nicaragua and why the advice is often to buy one here! If you have any questions, please leave a comment below.